Chances are that whatever methods, programs or software you have, the Affordable Care Act (ACA) requirements will challenge you to attain all the data necessary for compliance. Can you easily confirm benefits eligibility, manage the 90-day waiting period, how many hours worked, run data and create reports? Do you have a plan to file the ACA annual forms to the IRS?

With iSolved, you can share data between departments with increased accuracy and efficiency, saving you time and money while making sure you are in compliance.

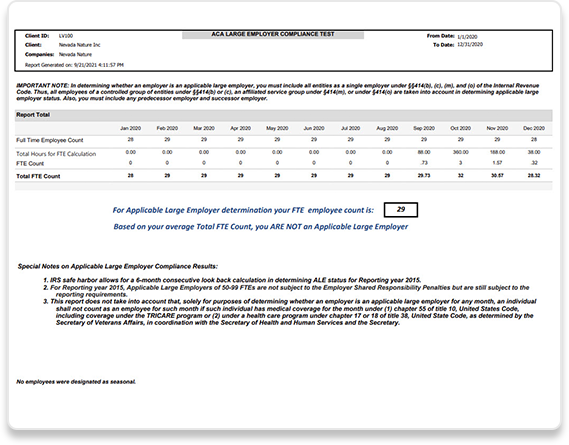

ACA Large Employer Compliance Test

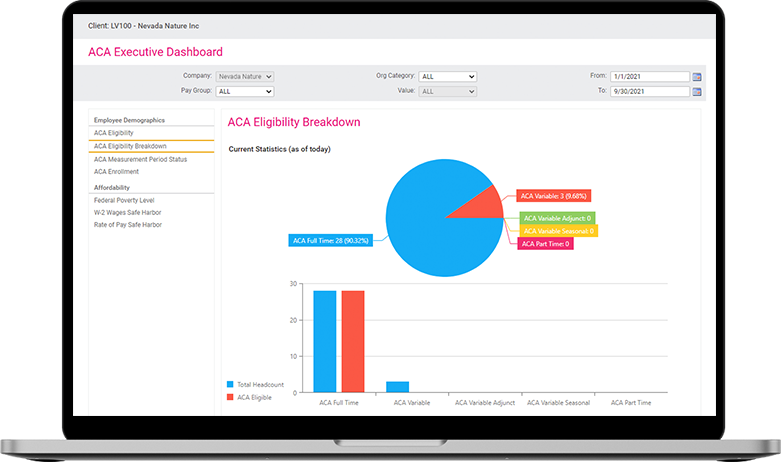

With iSolved, you can easily determine your ACA applicable large employer status and whether the employer shared responsibility rules (e.g., play or pay penalty) apply. You can even calculate the full-time employee count for multiple FEINs within a controlled group.

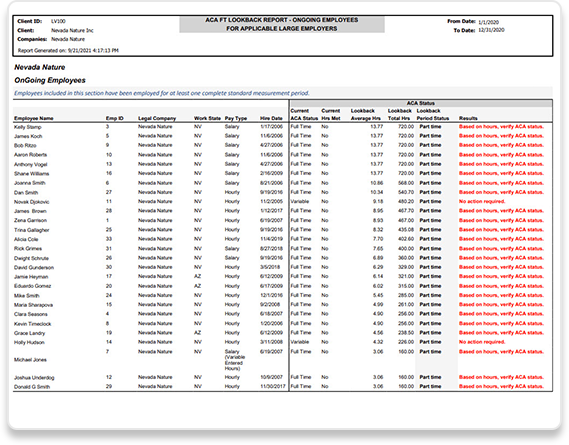

ACA Full Time Look-Back Report

You can manage the full-time status of your workforce in accordance with the ACA’s standard of 30 hours per week or 130 hours per month. An employee’s full-time (FT) status impacts the ACA rules on waiting periods, eligibility for minimum essential coverage and assessable payments (i.e., play or pay penalty). The ongoing employee measurement period is the employer’s standard measurement period. Annually, you will use a specific measurement period to look at all FT, part-time (PT) and variable hour new hires that have completed one unique measurement period. Used during the administrative period, this determines eligibility for benefits going into the next stability period. You can also monitor new hire variable hour employees during and at the end of their unique measurement period to determine whether or not they are now FT or PT

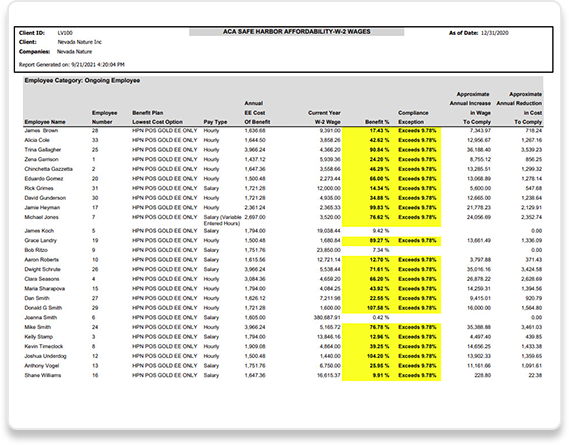

ACA Affordable Coverage Determination Report

You can run this report to determine whether minimum essential coverage is affordable for each FT employee based on the currently prescribed safe harbor methods. You can also enter an employee contribution based upon new plan year expectations and iSolved will use the prior year’s W-2 and provide a projected calculation. Failure to provide affordable coverage could result in an assessable payment (i.e., play or pay penalty).

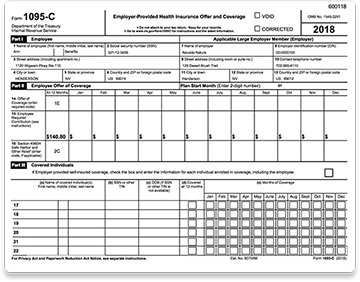

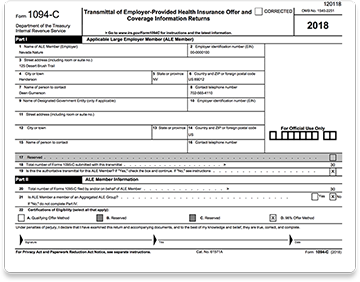

iSolved Will Produce 1094 & 1095 B & C Forms,

Making Your ACA Compliance Easy

You Will Be Able to Obtain the Reports You Need, When You Need Them

You Can Monitor Variable Hour Employee Hours With a Correct Initial Measurement Period

You Can Get Real Time Data for an Audit

You Can Easily Obtain Data to Determine Additional Costs You Are Experiencing

Manage COBRA eligible plans for W-2 reporting purposes

You Can Track Dependent Coverage and Other Elections

Data is available 24/7 and never purged. No complex software installs or updates necessary.